With the Tokyo Olympics scheduled to take place later this month, all eyes will be on Japan this summer. While there has been a backlash from the Japanese public as a result of Covid-19 concerns, the intentions of the International Olympic Committee remain in support of the games going ahead. Given this uncertainty has already been priced into Japan’s market, whether the games are staged or not has little impact on our portfolio.

Alongside the Olympic narrative, the re-opening trade has continued to make headlines in the media. This has been a hot topic for markets globally, although economies are opening up at different speeds regionally. Given lagged vaccination, Japan has underperformed global peers year-to-date, although we can expect this gap to narrow as the domestic vaccine rollout gathers momentum. Sentiment will be further supported by the uptick in earnings revisions, commodity reflation and a latent capex boom.

Over the long term we still believe Japanese equities are uniquely positioned to capitalise on both cyclical tailwinds – accelerating vaccination rollout and sensitivity to the global growth recovery – and structural tailwinds – beneficiaries of evolving technology and corporate governance reform as a game changer – at attractive valuations.

Pick-up in vaccination rollout

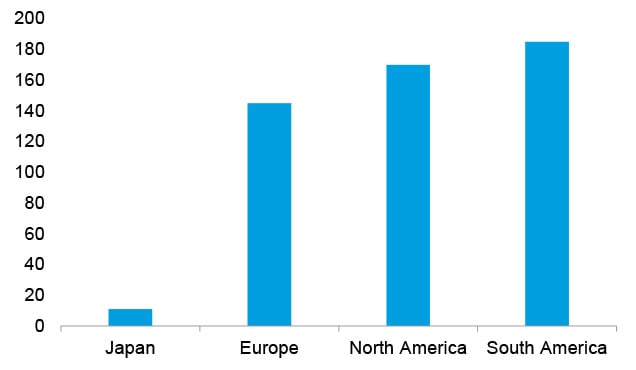

From a Covid perspective, Japan has one of the lowest mortality rates globally versus other countries. Figure 1 shows Japan death rates are significantly lower versus other regions, highlighting its effective handling of Covid. In fact, the total number of deaths in Japan in 2020 was less than that in 2019, which is a testament to its effective containment measures.

Figure 1: Covid-19 mortality rates (per 100,000)

Source: One World in Data, January 2020–June 2021

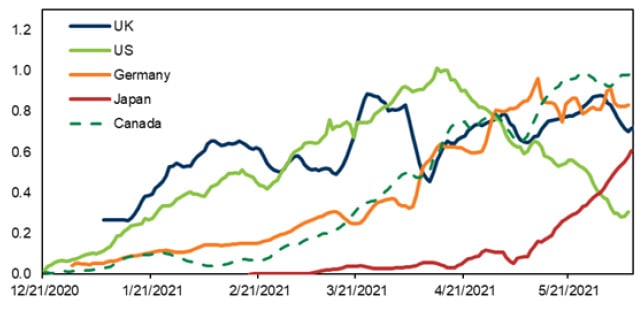

Partly because of this success, Japan’s vaccination rate has been lower than other major countries, but the vaccination rate started to pick up considerably in May (Figure 2).

Figure 2: Daily vaccinations as a percentage of population

Source: Goldman Sachs, June 2021

We have witnessed a positive correlation between the pace of vaccinations and equity market returns globally, and with Japan’s vaccination rate recently exceeding the 10% mark we believe this will help the index catch up with that of the US and Europe. If vaccinations progress in line with the government targets of one million doses a day, Japan should be able to achieve herd immunity later this year – which may be priced into the equity market sooner rather than later.

Pent-up savings a tailwind for the domestic economy

Japan as a key beneficiary of global recovery

Given Japan’s sensitivity to the global cycle is higher than most countries, the economy should be a key beneficiary of synchronised global recovery in 2021 with the expectation that domestic corporate earnings growth will rebound. More than 50% of the MSCI Japan Index falls under three sectors: industrials, information technology, and automotive-heavy consumer discretionary. This implies that the composition of the index helps investors enjoy superior returns when global growth starts to improve. If we view this from a style perspective, the weight of value stocks in Japan is almost double that of the global standard, with Japan the best performing market during global value rallies since 2010. We can therefore expect the current environment to provide investors with an attractive risk-reward trade off.

Healthy earnings recovery supported by attractive valuations

With the Japanese equity market one of the best performers over the past 10 years versus other global regions, it’s important to highlight that returns have been driven by earnings growth, unlike the material contribution from P/E multiple expansion in the US.

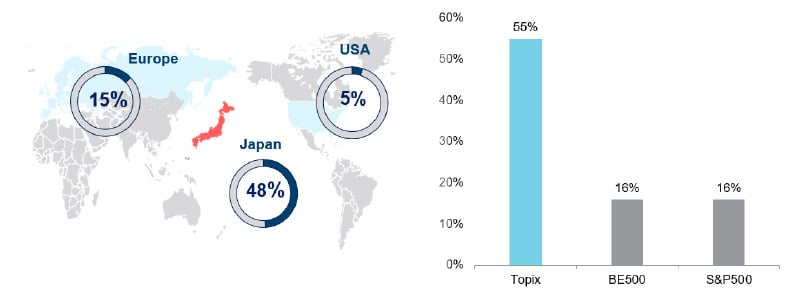

Japanese corporate earnings in 2021 are expected to grow around 25% year-on-year, while valuations remain attractive. Approximately half of Japanese companies in the Tokyo Stock Exchange Index are trading below book value and half of non-financial companies are net cash, which is significantly higher than that in the US and European equity markets. So, clearly, Japan is one of the most attractively priced equity markets globally.

Figure 3: % of stocks trading below book value (lhs); % of non-financials that are net cash (rhs)

Source: Nomura, March 2021. Indices shown include S&P500, BE500 and TOPIX

Unearthing hidden gems in Japan’s investment universe

We believe Japan is often overlooked by global investors – partly because of its lacklustre economic growth and aging population – despite offering a deep investment universe of high-quality companies that generate sustainable earnings growth. We believe it is precisely those high-quality and dominant franchises that can sustain strong and consistent earnings growth without relying on leverage or macro conditions. Often, these companies incorporate a combination of innovation, disruption, overseas expansion and a strong focus on return on invested capital.

With innovation a big focus for us, we seek to identify companies with leading technologies, strong branding power and unique business models. Japan’s investment universe is rich with these kinds of companies that have dominant market share in industries driven by secular growth: factory automation technology, medical equipment and semiconductor products to name a few. We continue to identify companies in the following areas where we see long-term structural opportunities:

Automation and robotics: With Japan a global leader in robotic and automation technology, we expect a global aging demographic to support trends in automation, remoteness and digitalisation of social infrastructure which is a structural tailwind for companies such as Keyence, Fanuc and Yaskawa. With automation allowing companies to devote fewer human resources to physical jobs, this enhances productivity and profitability to core operations.

Strong consumer brands: On the consumer side, Japanese brands have a vast market on their doorstep with strong demand across Asia – and are key beneficiaries of the rising middle class across the region with more disposable income. We can gain exposure to these markets through investing in quality Japanese companies – Toyota, Sony and Shiseido – where products are extremely popular due to their focus on quality and innovation.

Software revolution Japan: has recently put greater focus on embracing the use of innovative software solutions given western economies such as the US and the UK are ahead in the adoption of cloud computing technology and digitalisation. The adoption of such technology can help transform Japan’s economic and corporate landscape for the better, helping to alleviate labour shortages, boost productivity and economic growth, while also improving corporate competitiveness and profitability. As the rollout continues, we expect this to give rise to many long-term investment opportunities across areas such as ecommerce, cloud-based business software and cashless payment solutions – with companies such as Z Holdings, Freee and GMO Payment Gateway among key beneficiaries.

Corporate governance reform

Japan’s corporate governance reform has taken a leap forward following a published proposal for the revision of Japan’s Corporate Governance Code and Guidelines for Investor and Company Engagement. The proposal marks another step forward in the evolution of the corporate structure of Japanese companies. The main points of the proposed revisions include enhancing board independence, promoting its diversity, attention to ESG and improving capital management policy.

With Japanese corporates consistently increasing dividends and share buybacks as a result of positive corporate governance reform, we believe the trend of returning excess cash to shareholders and investing capital for future growth is back on track – which is expected to significantly contribute to a higher return on equity.