Campaign

Threadneedle (Lux) Global Investment Grade Credit Opportunities Fund

Consistently seeking the best opportunities in investment grade credit

Threadneedle (Lux) Global Investment Grade Credit Opportunities Fund is an active credit fund designed to target cash-plus returns over the medium term by investing in Columbia Threadneedle’s best ideas in global investment grade credit. With the flexibility to invest in both long and short strategies, our new fund aims to exploit our highest conviction ideas and generate positive returns regardless of market conditions.

Overview

- An active, absolute return credit fund that aims to deliver positive cash-plus returns by investing in the best opportunities in global investment grade credit.

- With the ability to generate returns from both rising and falling markets by going short (as well as long) credit market risk and individual issuer exposure, this fund has the potential to generate positive returns regardless of market conditions.

- Focussing primarily on developed markets, the fund also has the flexibility to invest in developed market asset-backed and emerging market corporate credit, as well as developed market high yield up to a maximum of 10%. These investments will typically be the subordinated debt of investment grade issuers.

- Utilises the established and successful investment approach from an experienced team with a long track record in managing both traditional long-only and absolute return investment grade credit strategies. The team have successfully run the investment grade portion of the Threadneedle Credit Opportunities Fund1 for the past eight years, through a number of economic and credit cycles.

- The fund follows our well-established approach to managing credit portfolios that is founded on intensive fundamental research to uncover the best global credit ideas.

- With developed market interest rates and bond yields close to historical lows, an absolute return approach would be well placed should interest rates or bond yields begin to normalise.

Launch date

27 March 2018

Fund Managers

Alasdair Ross

Ryan Staszewski

Performance Target

Citigroup EUR 1 Month Eurodeposit plus 250bps (gross of charges and tax) over the medium term*

¹The reference to the Threadneedle Credit Opportunities Fund is for illustrative purposes only and does not constitute an offer or solicitation of an order to buy or sell any securities or other financial instruments, or to provide investment advice or services.

Philosophy and process

We believe that given solid fundamental credit insights, a reasonable time horizon, and the ability to withstand short-term volatility, credit opportunities in the investment grade corporate bond market can be exploited to achieve attractive risk-adjusted returns. Our investment approach is built around robust credit research, portfolio construction and risk management.

Our highly experienced and well-resourced team of credit research professionals work closely together in a collaborative and interactive environment, and consistently apply a proprietary process which results in a deep understanding of issuer and industry dynamics and allows the team’s best investment ideas to emerge.

The credit analysts deliver formal investment recommendations, risk ratings and internal credit ratings for the issuers they follow. Each investment recommendation is accompanied with a thesis statement, which includes an issuer risk score. This statement includes the analyst’s expectations (and risks around) the evolution of financial metrics, operating results and management behaviour.

In addition, analysts set out which parts of the thesis are critical to the recommendation and list the events that might trigger a change in view. These recommendations and ratings, in combination with a relative value assessment of each issuer, form the basis of security selection, position sizing and risk monitoring.

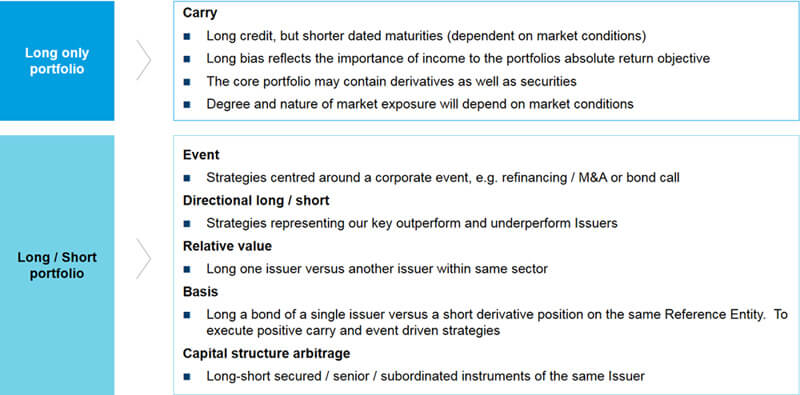

The fund is constructed with a portfolio of short maturity investments with additional overlay strategies aiming to provide additional returns. These include Event, Directional long/short, Relative Value, Basis and finally Capital structure arbitrage strategies. The portfolio managers will actively allocate risk to whichever mix of instruments is expected to provide strong risk-adjusted returns.

Insights

Market Monitor – 19 April 2024

In search of sustainability – following Highway 101

In Credit Weekly Snapshot – April 2024

Literature

Fund Manager

Alasdair Ross is Head of Investment Grade Credit, EMEA, with responsibility for our UK and European investment grade corporate credit teams based in London. Alasdair is lead portfolio manager across various global, euro and UK corporate credit portfolios including Threadneedle (Lux) Global Corporate Bond Fund, Threadneedle European Corporate Bond Fund, Threadneedle UK Corporate Bond Fund and is also deputy portfolio manager on the Threadneedle Credit Opportunities Fund.

Alasdair's investment background is as a fundamental, bottom-up, investment grade credit analyst. Between joining the company in 2003 and becoming a portfolio manager in 2007, he had responsibility for covering the TMT, utility and energy sectors, as well as the sterling whole business securitisation sector.

Prior to joining the company, Alasdair worked at BP plc in a rotation of commercial roles.

Alasdair has a first-class honours degree in Politics, Philosophy and Economics from the University of Oxford. He also holds the Chartered Financial Analyst designation.

Ryan Staszewski is a portfolio manager at Columbia Threadneedle Investments. Ryan is responsible for European credit portfolios within the fixed income team in London. Previously, he worked as a credit analyst undertaking fundamental analysis across a number of sectors within the investment grade universe.

Prior to joining one of the Columbia Threadneedle Investments firms in 2012, Ryan held a role as a sell-side publishing analyst at JP Morgan, where he was voted the #2 utilities analyst by industry peers in the Euromoney 2012 fixed-income survey. Prior to that, he was a buy-side credit analyst at Aviva Investors.

Ryan received a degree in economics and finance from Curtin University, Western Australia, and is also a CFA Charterholder.

For internal use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients). Threadneedle (Lux) is an investment company with variable capital (Société d’investissement à capital variable, or “SICAV”) formed under the laws of the Grand Duchy of Luxembourg. The SICAV issues, redeems and exchanges shares of different classes. The management company of the SICAV is Threadneedle Management Luxembourg S.A, who is advised by Threadneedle Asset Management Ltd. and/or selected sub-advisors. The SICAV is registered in Austria, Belgium, France, Finland, Germany, Hong Kong, Italy, Luxembourg, The Netherlands, Portugal, Spain, Sweden, Switzerland, Taiwan and the UK; however, this is subject to applicable jurisdictions and some sub-funds and/or share classes may not be available in all jurisdictions. Shares in the Funds may not be offered to the public in any other country and this document must not be issued, circulated or distributed other than in circumstances which do not constitute an offer to the public and are in accordance with applicable local legislation. This material is for information only and does not constitute an offer or solicitation of an order to buy or sell any securities or other financial instruments, or to provide investment advice or services. Subscriptions to a Fund may only be made on the basis of the current Prospectus and the Key Investor Information Document, as well as the latest annual or interim reports and the applicable terms & conditions. Please refer to the ‘Risk Factors’ section of the Prospectus for all risks applicable to investing in any fund and specifically this Fund. The above documents are available free of charge on this website. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. Threadneedle Management Luxembourg S.A. Registered with the Registre de Commerce et des Sociétés (Luxembourg), Registered No. B 110242, 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. columbiathreadneedle.com